With the spread of the coronavirus (COVID-19) pandemic across New York State, the United States, and the world, now more than ever we have been challenged to find new ways to mitigate the spread of the virus.

This includes the way we do everyday activities — including banking. To help you navigate the coronavirus pandemic, here are four ways to help manage your finances from the comfort of home.

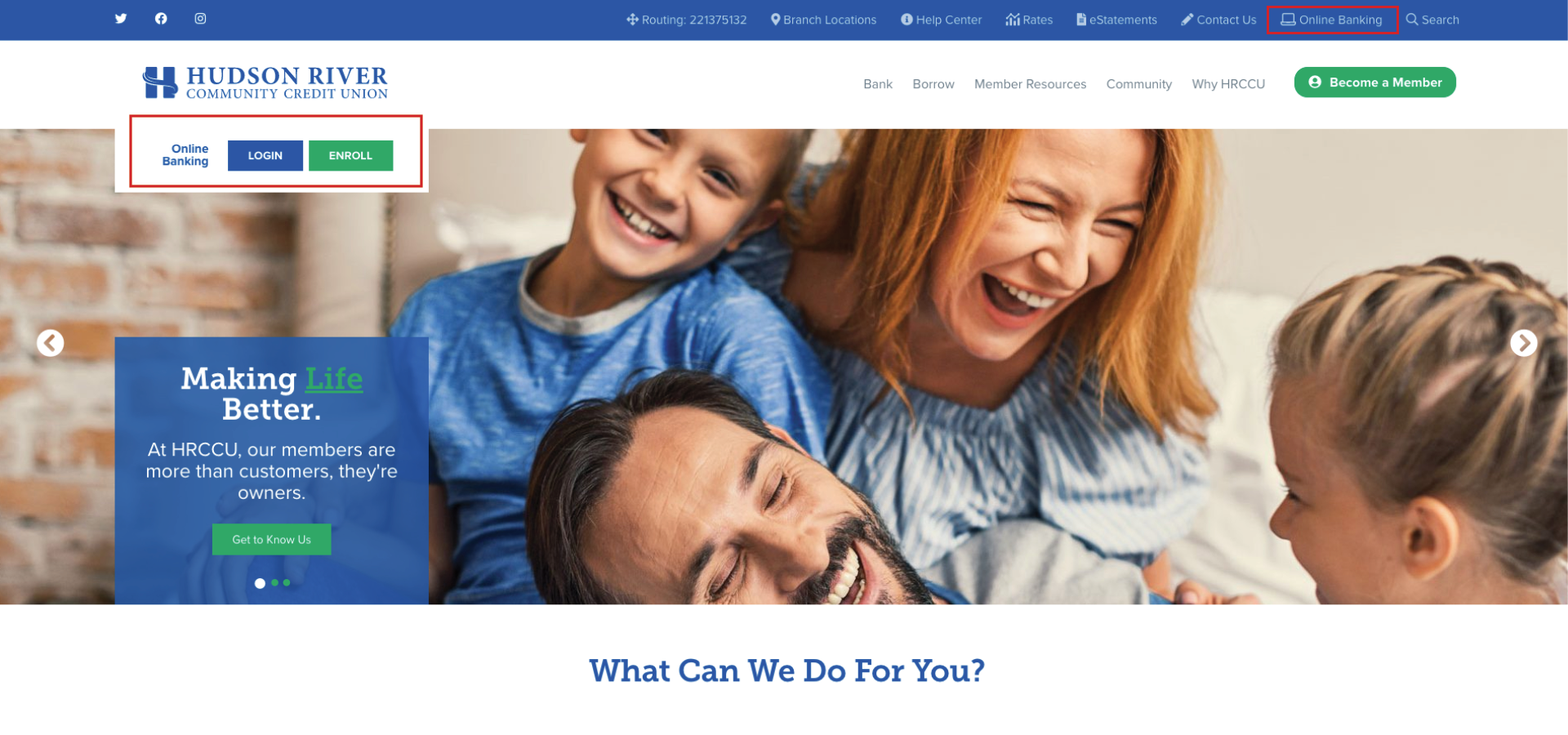

1. Online and Mobile Banking Services

Online and mobile banking services offer people the opportunity to conduct financial transactions from the comfort of their home.

This technology makes it one of the most important ways a person can continue to manage their finances during a pandemic.

Most banks and credit unions, including HRCCU, offer online and mobile banking services that are user-friendly and give members the power to access their accounts on the go.

Members with online banking accounts can complete a variety of financial transactions at their convenience, including:

- Viewing account balances and transaction history 24 hours a day

- Transferring funds between accounts within HRCCU and externally

- Depositing checks remotely

- Paying bills securely

- Paying friends and family

- Applying for a loan

- Making loan payments

- Managing expenses of internal and external accounts

These are just a few ways that HRCCU’s online and mobile banking makes it easy to maintain your finances without leaving home.

If you are a member of HRCCU and are not currently enrolled in online banking, you can enroll online by filling out your personal member information.

Once enrolled, don’t forget to download our mobile app on your Apple or Android devices for the best user experience.

If you are having trouble creating your online account, you can also contact our Member Experience Center at 518-654-9028 and one of our representatives will be happy to assist you.

2. Enroll in direct deposit

If you are not currently enrolled in direct deposit, now is a great time to talk to your employer about setting up direct deposit payments with your financial institution.

This will mitigate the need to visit the credit union or bank to deposit your funds into your account. If you still receive a paper check for Social Security or other federal benefit payments, you are out of compliance with the law.

The Treasury Department requires federal benefit payments to be made electronically. You can enroll in automatic deposits of these benefits at GoDirect.

3. Keep cash on hand

No matter the emergency, it’s always a good idea to keep some cash handy just in case it is needed to make payments.

This will also decrease the need to visit your financial institution or ATM, which could be difficult depending on the severity of the pandemic.

4. Gather important documents

It’s always important to gather personal financial, insurance, and medical records in case of an emergency.

Print copies and store them in a secure location and be sure to backup electronic files in a protected environment.

You should also keep a list of important account numbers and financial contacts in case you need to access these accounts or contact your financial institution.

Contact Us Today

HRCCU is here to help you manage and protect your money during these unprecedented times.

Contact us today and speak to our financial team via phone, email, or mail.